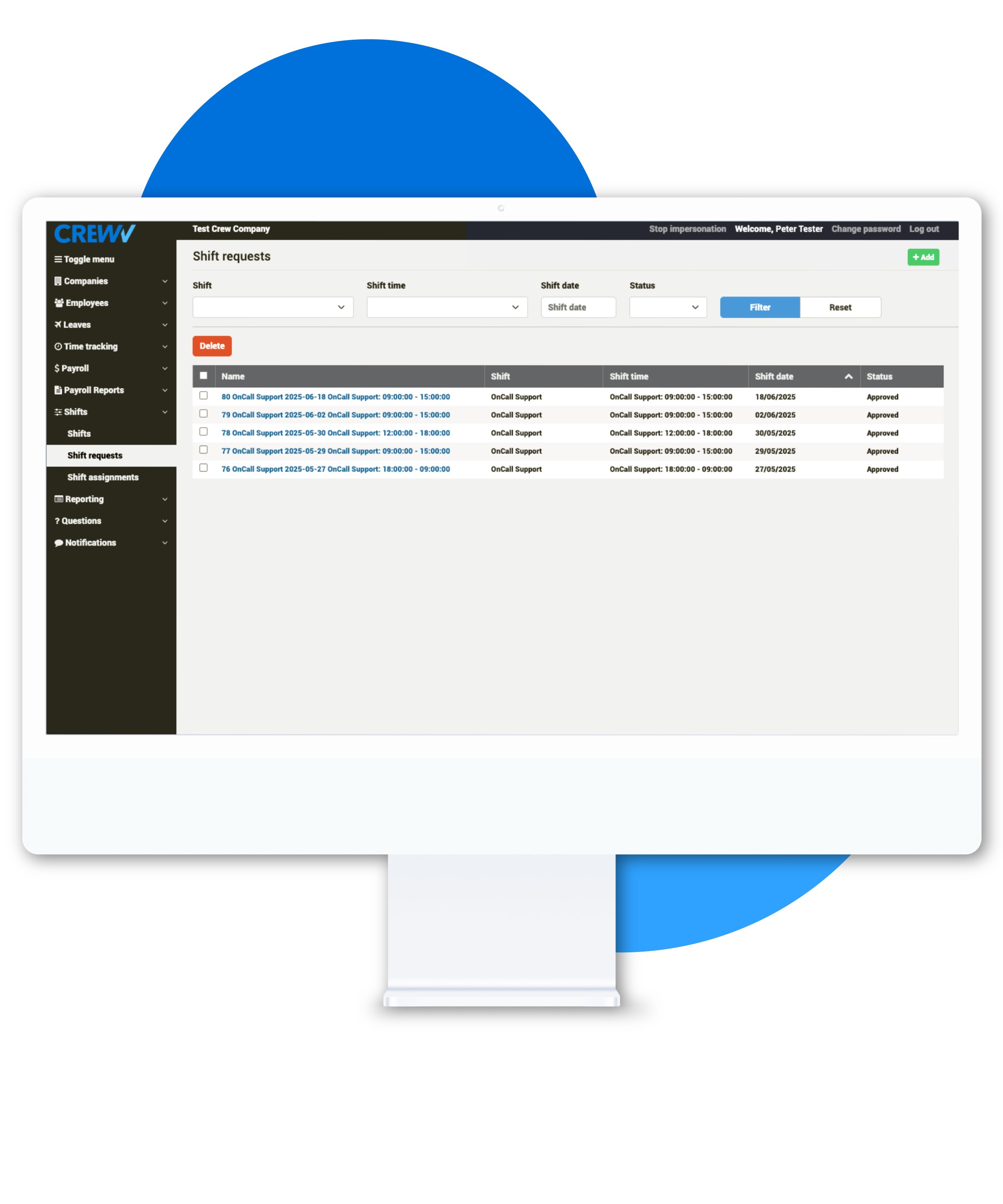

The payroll manager can generate and review the payslips for all employees.

Ability to have custom payslip templates per department / role / employee. Crew supports an extensive range of earnings, deductions and company contributions, along with the ability to create custom ones. Payroll manager generates the payroll which must be approved. Once approved the file for social insurance can be downloaded. The bank payment file is aligned with the European banking standards and can be downloaded after payroll is approved.

Crew payroll can also consider any additions to your income or custom deductions to which you are entitled to.

You can incorporate that information for each employee so their actual Tax Deduction is calculated properly. Through the system, employees can also receive all the annual tax-related forms, complete them, and submit them back to the system.

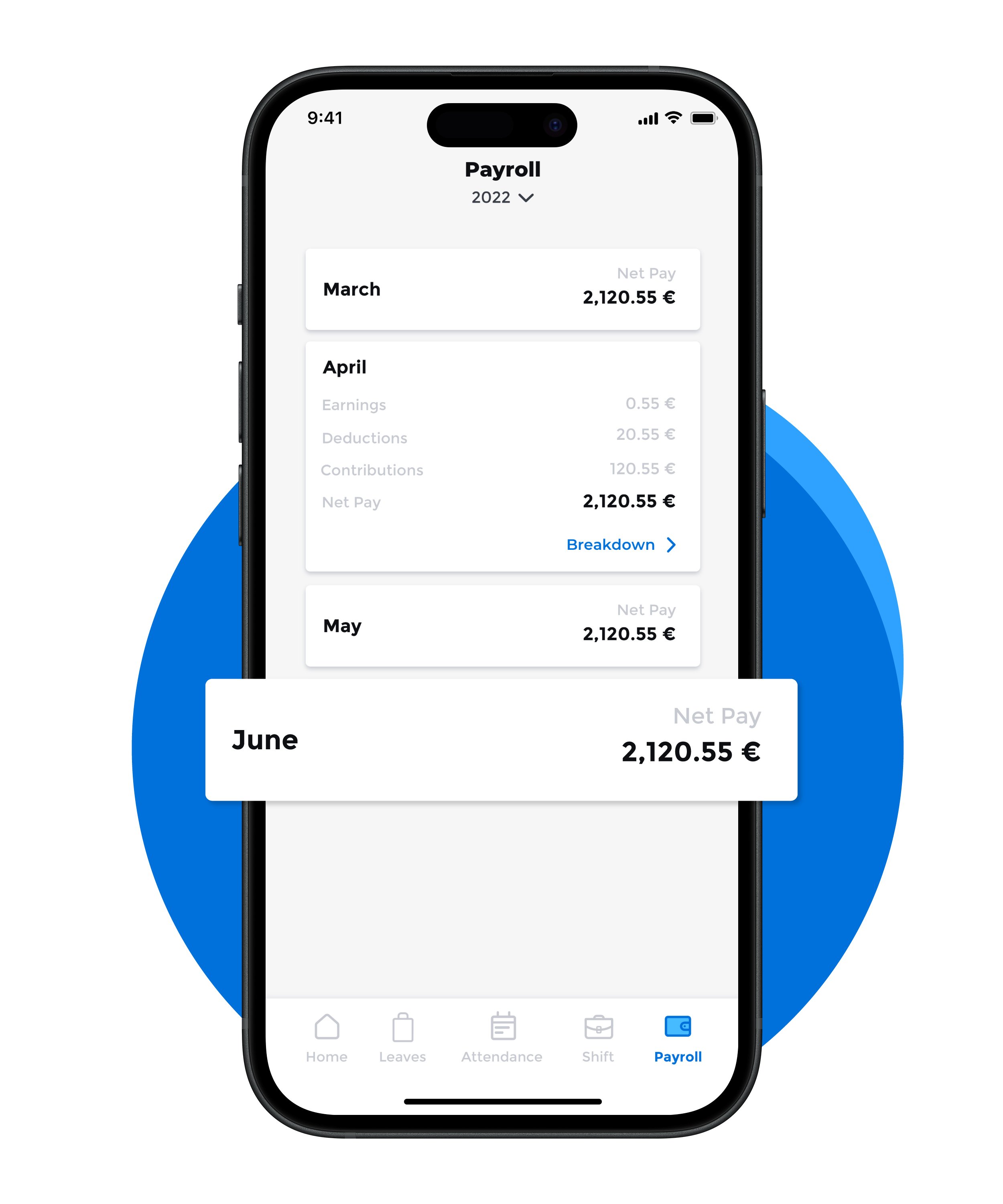

Your Payslips at a Glance

In the Crew mobile application there is a dedicated section where employees can view all their payslips along with all the information and components included in each one. The full payslip history of each emplolyee is available in the Crew self service mobile app. Users can also request to receive their payslips in PDF format if needed.

We value your privacy and personal data more than anything.

We understand that payroll contains sensitive and personal information, hence access to that information is only limited to assigned employees within the company and no one other than the employees themselves.

Pricing is based on the modules you utilise and the size of your business. You get access to:

- All the features included in your modules

- Early access to new features

- Training material to help you get started

- 30-days free trial

- Unlimited email support included

- Frequent webinars to demonstrate the platform and new features